Secondary real estate —

worldwide

Meilleures offres

en Secondary real estate

Popular countries

2025

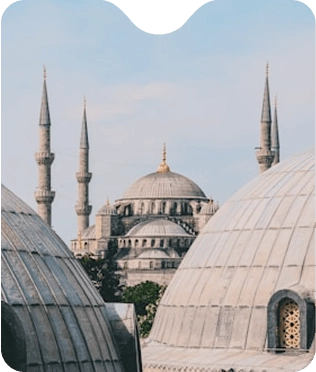

Turkiye

Secondary real estate in Turkiye ✅ Buy apartments, villas or houses on secondary market in Turkiye without intermediaries. Best online catalog of secondary property in Turkiye from VelesClub Int. expert

Portugal

Secondary real estate in Portugal ✅ Best offers on secondary market in Portugal without intermediaries. Verified online catalog of secondary real estate in Portugal from VelesClub Int. expert

Bali

Secondary real estate in Bali, Indonesia ✅ Buy apartments, villas or houses on the secondary market in Bali without intermediaries. Best online catalog of secondary real estate in Bali from VelesClub Int. expert

Cyprus

Secondary housing in Cyprus ✅ Best offers on secondary market in Cyprus without intermediaries. Verified online catalog of secondary property in Cyprus from VelesClub Int. expert

Greece

Secondary real estate in Greece ✅ Buy apartments, villas or houses on the secondary market in Greece without intermediaries. Best online catalog of secondary real estate in Greece from VelesClub Int. expert

France

Secondary elite housing in France ✅ Best offers on secondary elite market in France. Verified online catalog of resale luxurious property in France from VelesClub Int. expert

Serbia

Secondary property in Serbia ✅ Buy housing on secondary market in Serbia without intermediaries. Best online catalog of secondary real estate in Serbia from VelesClub Int. expert

Thailand

Secondary real estate in Thailand ✅ Best offers on secondary market in Thailand without intermediaries. Verified online catalog of secondary housing in Thailand from VelesClub Int. expert

Who is it for

buying

secondary real estate

VelesClub Int. helps clients buy secondary real estate for living, rental, or relocation. We offer verified options and full support — from selection to final deal.

Relocating

buyers

Moving to a new country or city? Secondary homes are already built and connected — so you can settle in without delays.

Rental income

buyers

Planning to rent out right away? Many secondary homes are ready for tenants and deliver instant rental returns.

Budget-conscious

buyers

Looking to save? Secondary homes often offer better prices, room for negotiation, and flexible terms.

Location-first

buyers

Prefer central areas or historic districts? Secondary real estate opens access to locations where new builds are rare.

Methods of purchase

real estate in 2025–2026

We offer flexible

and modern conditions for purchasing real estate. Choose a convenient method, and our specialists

will take care of everything

Cash

Ideal for those who want a quick deal without debt obligations and the risk of currency fluctuations. Our specialists will ensure minimal formalities and safe registration to avoid hidden commissions and taxes.

Mortgage

An excellent option for maintaining liquidity. We will select the optimal mortgage program in the country of purchase and take care of the legal purity of the transaction. You can be sure of the absence of hidden conditions and an honest assessment of the interest rate and payment schedule.

Installment

Provides the opportunity to split payments into several stages. A completely safe process with flexible payment terms and access to the property immediately after the transaction is completed. You will receive a full understanding of the terms to avoid surprises in the payment schedule.

Cryptocurrency

A modern way of buying, providing flexibility and security. Suitable for those who prefer anonymity and speed of transactions without reference to exchange rates. We will provide full legal control and protection so that the transaction is as reliable as possible.

Investing in real estate

is more than just buying square meters.

It’s choosing the future

Investing in real estate

is more than just buying

square meters.

It’s choosing the future

Investing

in real estate

is more than just buying

square meters.

It’s choosing the future

What to pay attention to

Projected increase in the value of the object

Legal purity of the transaction

The presence of additional expenses

Get relevant investment tips and offers straight to your email

What to pay attention to

Projected increase in the value of the object

Legal purity of the transaction

The presence of additional expenses

Get relevant investment tips and offers straight to your email

What to pay attention to

Projected increase in the value of the object

Legal purity of the transaction

The presence of additional expenses

Get relevant investment tips and offers straight to your email

We create a comfortable path to your ideal

real estate,

uniting all stages of the transaction

into a single ecosystem

We are here to answer all your questions. Get professional recommendations and solutions from our specialists.

Expert support

Each stage of the transaction is supervised by professionals with many years of experience

Turnkey

We take on all tasks: from selecting properties to legal registration and insurance, saving your time and effort.

Individual solutions

We select a strategy for your goals: from personal residence to high-yield investments.

What should I check before buying a secondary property?

"When buying secondary property, it’s important to check: • The property’s legal status and ownership history • Encumbrances or debts associated with the property • The technical condition of the apartment or house • Utility payments and potential outstanding bills We will help you verify all these aspects and ensure a safe transaction."

For more details, see the article "Topic of article". Click on the link to go

If you have not found the answer

to your question, our AI assistant is ready to help you!

Write your question in any language and get a detailed answer within a couple of minutes

If you have not found the answer

to your question, our AI assistant is ready to help you!

Write your question in any language and get a detailed answer within a couple of minutes

VelesClub Int. team here to answer

all your questions

We offer flexible and modern conditions for buying secondary real estate. Choose a convenient method, and our specialists will take care of everything.

If you have not found the answer

to your question, our AI assistant is ready to help you!

Write your question in any language and get a detailed answer within a couple of minutes

Leave a request,

and our experts will contact you to

Every expert

VelesClub Int. —

is your friend

For developers, owners and brokers

We help to sell your property profitably, using a comprehensive approach and professional marketing

Full transaction support:

from documentation preparation to the final stageEvaluation and promotion of the property based on market analytics

Attracting the target audience through proven channels

International Secondary Real Estate Investment Opportunities

Investing in real estate has long been a proven strategy for wealth creation and portfolio diversification. In today’s global market, international secondary real estate investments have emerged as an attractive option for investors seeking stability, transparency, and immediate income potential. By focusing on established, resale properties, savvy investors can tap into opportunities that combine historical performance with promising future growth.

Investment Opportunities in the Secondary Real Estate Market

The secondary real estate market—comprised of pre-owned or resale properties—offers a wealth of opportunities that set it apart from new developments. Properties in this segment come with a proven track record, robust infrastructure, and established communities. For international investors, these factors translate into a lower-risk entry point into foreign markets and the potential for swift returns. As global economies evolve, the demand for stable and mature real estate investments has never been higher.

What is Secondary Real Estate Investment?

Secondary real estate investments refer to the purchase of properties that have previously been owned and occupied. These assets, often listed under terms such as “Secondary Investment Property for Sale” or “Established Residential Property Investment,” have already withstood market fluctuations and have a documented performance history. Investors appreciate these qualities because they offer an opportunity to acquire properties with established value, reducing the uncertainties typically associated with new constructions. The resale market provides transparency in pricing, a wealth of historical data, and a clear picture of property maintenance and neighborhood evolution.

Market Trends and the Advantages of Established Properties

Recent global trends underscore the benefits of investing in mature real estate markets. As investors become more risk-aware, “Established Property Market Trends” and “Mature Real Estate Markets” have garnered significant attention. Properties in these segments tend to be located in well-developed areas with stable economic growth, sound legal frameworks, and reliable rental yields. Such markets are characterized by lower volatility compared to emerging markets, thereby offering a dependable platform for achieving long-term capital appreciation. This stability is particularly appealing for international investors looking for secure and profitable investments.

Why Invest in Resale Properties?

Resale properties present numerous advantages that make them an attractive proposition for discerning investors. First, these properties come with a verifiable history, allowing investors to analyze past performance and anticipate future trends. This transparency facilitates a smoother decision-making process, as potential issues or maintenance histories are already documented. Moreover, the inherent “Resale Home Investment Benefits” include quicker occupancy, established neighborhood amenities, and a higher likelihood of immediate rental income. For those seeking “Profitable Existing Property Investments,” secondary real estate offers a balanced combination of risk mitigation and potential for high returns.

Overview of Secondary Investment Properties for Sale Worldwide

Discover Secondary Investment Properties for Sale Worldwide

The international secondary real estate market is vast and diverse, providing investors with access to properties across continents and in various economic climates. Whether you are looking to “Buy Secondary Real Estate Abroad” or explore “International Resale Property Listings,” there is a wealth of opportunities waiting to be discovered. This segment of the market is especially appealing for investors who prefer properties with an established track record, ensuring that every investment decision is backed by tangible performance data and real-world market stability.

The Benefits of Buying Secondary Real Estate Abroad

Investing in secondary real estate abroad carries unique advantages that extend beyond the borders of any single market. One of the most compelling benefits is the opportunity to acquire properties that are immediately operational and revenue-generating. With “Existing Residential Real Estate Opportunities” available in numerous countries, international investors can diversify their portfolios while mitigating the risks often associated with developmental or speculative projects. Moreover, resale properties abroad typically come with the added assurance of established legal documentation, solid property management histories, and proven rental performance—all of which contribute to a smoother investment process.

Established Residential Property Investment Opportunities

The global landscape of resale properties is replete with opportunities that cater to a wide range of investment strategies. Investors can choose from luxury apartments in historic urban centers to comfortable family homes in suburban communities—all falling under the umbrella of “Established Residential Property Investment Opportunities.” These assets are often highlighted in detailed “Resale Property Catalogs” that provide insights into property history, current market performance, and future potential. Furthermore, employing “Existing Property Investment Strategies” in these mature markets allows investors to capitalize on predictable income streams and long-term value appreciation, making them a preferred choice for those who prioritize reliability and profitability.

Success Stories in the Secondary Real Estate Market

Time and again, success stories from the secondary real estate market have reinforced its appeal to international investors. Numerous case studies illustrate how investors have achieved significant returns by purchasing properties in established markets. For example, investors in select European cities and stable Asian markets have benefited from consistent rental incomes and appreciable property values over time. These success narratives not only underscore the viability of resale investments but also serve as a powerful endorsement for those contemplating a move into international secondary real estate. The tangible benefits—ranging from immediate cash flow to long-term capital gains—make it clear why many investors are turning to resale properties as a cornerstone of their investment portfolios.

Guide to Buying Secondary Real Estate Abroad

How to Buy Secondary Real Estate Abroad: A Comprehensive Guide

Navigating the international property market requires a blend of local expertise and global insight. For investors ready to expand their portfolios beyond domestic borders, understanding the nuances of buying secondary real estate abroad is crucial. This comprehensive guide is designed to walk you through each step of the process, from identifying lucrative opportunities to finalizing a successful purchase. By leveraging proven strategies and expert advice, you can minimize risks and maximize returns in a competitive market.

Navigating International Resale Property Listings

The first step in any international real estate investment is to identify the right property. Today, “International Resale Property Listings” offer a treasure trove of data, including detailed descriptions, photographs, and historical performance metrics. When navigating these listings, it is essential to conduct thorough research—scrutinize the property’s location, evaluate its historical performance, and understand local market conditions. Consider factors such as proximity to key amenities, transportation links, and future development plans. By applying rigorous analytical criteria, you can filter out properties that do not meet your investment criteria and focus on those that promise solid returns.

Legal Considerations and Financing Your Secondary Investment

One of the critical aspects of investing in secondary real estate abroad is ensuring that all legal and financial matters are meticulously addressed. While regulations vary across countries, a general framework applies: verifying property titles, ensuring compliance with local laws, and understanding the tax implications of cross-border investments. Investors should engage legal experts familiar with the local market to confirm that the property is free from liens or disputes. Additionally, financing plays a pivotal role. Many investors secure funds through local banks or international lenders specializing in real estate financing. An in-depth review of mortgage options, interest rates, and repayment terms is essential to avoid unexpected financial burdens. A well-structured financing plan not only safeguards your investment but also enhances its potential for yielding profitable returns.

Expert Tips for a Successful Resale Property Purchase

To wrap up this section, consider these expert tips that can significantly improve your chances of success when purchasing resale properties abroad:

• Conduct Comprehensive Due Diligence: Investigate the property’s history, market value, and local economic conditions. Use reputable sources and, if possible, secure a professional property inspection.

• Leverage Professional Networks: Engage with local real estate agents, legal advisors, and financial consultants who specialize in international transactions. Their local market knowledge can be invaluable.

• Plan Your Finances Carefully: Obtain pre-approval for financing and compare mortgage offerings from various lenders. A clear understanding of your financial capacity will empower you to negotiate effectively.

• Stay Informed with Market Analysis: Regularly review “Secondary Property Market Analysis” reports to stay abreast of the latest trends and opportunities. This information can provide insights into market fluctuations and ROI potential.

• Consider Turnkey Investments: Properties that are ready for immediate occupancy—referred to as “Turnkey Existing Property Investments”—can offer a faster return on investment as they require minimal post-purchase work.

By following these guidelines, investors can navigate the complexities of purchasing international resale properties with confidence and precision. The process may seem challenging at first, but with meticulous planning and expert support, secondary real estate investments can become a cornerstone of a robust, diversified portfolio.

Analysis and Strategies for Investing in Secondary Real Estate

Analyzing the Established Property Market Trends

Understanding market trends is essential for making informed investment decisions in secondary real estate. Mature markets are characterized by steady demand, transparent pricing, and well-established legal frameworks. By keeping an eye on “Established Property Market Trends” and monitoring “Mature Real Estate Markets,” investors can gauge the overall economic health and long-term potential of their target regions. In many cases, detailed market analyses and periodic reports help in identifying areas where property values are set to appreciate, allowing investors to time their entry and exit with precision.

Comparing Secondary Market Homes vs. New Developments

When considering real estate investments, one critical decision is whether to invest in a resale property or a new development. Secondary market homes come with a proven performance history, lower risk, and immediate income potential due to their established status. In contrast, new developments may offer modern amenities and customized designs but often carry higher risks and longer waiting periods before generating returns. For international investors prioritizing reliability and immediate cash flow, the benefits of “Resale Property for Investment” frequently outweigh those of new constructions. This comparison highlights why many investors prefer established properties when seeking “Existing Homes for Sale Abroad.”

Investment Strategies for High ROI in Secondary Real Estate

Achieving a high return on investment (ROI) in the secondary real estate market requires a blend of careful planning and strategic insight. Investors should consider a range of factors including location, property condition, historical performance, and future market projections. Strategies such as diversifying across multiple established markets, investing in turnkey properties, and leveraging local market expertise can significantly boost ROI. Emphasizing “Secondary Market ROI Real Estate” and utilizing “Existing Property Investment Strategies” ensures that each investment is aligned with broader portfolio objectives. By adopting a proactive approach that includes regular market analysis and timely reinvestment, investors can optimize their returns while mitigating risks.

Case Studies: Profitable Pre-Owned Residential Property Listings

Real-world examples serve as powerful validation of the strategies outlined above. Numerous case studies illustrate how investors have successfully navigated the secondary real estate market to secure profitable returns. For instance, several investors have turned properties in key European and Asian markets into consistent revenue streams through strategic renovations and targeted rental management. These “Profitable Existing Property Investments” not only confirm the reliability of mature markets but also highlight the potential for value appreciation and enhanced cash flow. Such case studies reinforce the advantages of investing in resale properties and provide actionable insights for those looking to build a robust international portfolio.

Conclusion and Next Steps

Secure Your Future with International Secondary Real Estate Investments

In a rapidly evolving global economy, securing a stable financial future is paramount. International secondary real estate investments offer an ideal combination of reduced risk, proven market performance, and immediate revenue potential. By choosing properties with a verified history and established market presence, investors are better positioned to weather economic fluctuations and enjoy long-term capital growth.

Recap of Key Investment Advantages

To summarize, the secondary real estate market provides international investors with:

• A track record of stability and reliable performance.

• Immediate income generation due to established tenant bases.

• Lower risk compared to new developments.

• Transparency in pricing and historical performance data.

• The opportunity to leverage “Established Residential Property Investment” strategies for long-term gains.

These advantages make resale properties a compelling option for those seeking secure and profitable investments in mature markets.

Next Steps: How to Invest in Turnkey Secondary Properties

For investors ready to explore these opportunities, the following steps can serve as a roadmap:

1. Research and Analysis: Start by reviewing market reports and “Secondary Property Market Analysis” to identify regions with stable performance.

2. Due Diligence: Conduct thorough inspections and verify the property’s history to ensure it meets your investment criteria.

3. Financial Planning: Secure pre-approved financing and compare various mortgage options to optimize your investment budget.

4. Engage Experts: Collaborate with local real estate professionals who understand the nuances of international resale markets.

5. Turnkey Solutions: Consider properties that are fully renovated and ready for immediate occupancy—ideal for those seeking “Turnkey Secondary Property Investments.”

Are you ready to take the next step in building a diversified, high-performing portfolio? Connect with VelesClub Int. today to access exclusive information and personalized assistance in acquiring resale properties abroad. Visit our Contacts page to speak with our expert team and start your journey toward secure, profitable international real estate investments.