Investment projects —

real estate that

generates income

Best offers

in investment projects

Popular Countries

2025

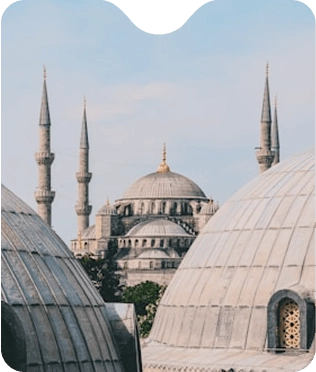

Turkiye

Ideal start for investors: real estate by the sea with rising prices and high demand

Portugal

Real estate investment with the possibility of obtaining residence permit

Spain

Profitable property in the sun

Cyprus

Property in the center of a tourist paradise

Greece

Investments in real estate with the possibility of obtaining residence permit

France

Property in the center of a tourist paradise

Serbia

The heart of the Balkans for investment

Thailand

Invest in apartments that are open all year round

Who is it for

investing

real estate

Our team helps clients with different goals and needs make smart investments in real estate. We select ideal options, support transactions and make the process as simple as possible.

Investors seeking

scalable assets

You’re ready to go beyond single units and buy into full buildings or mixed-use complexes — with better margins, larger volume, and long-term upside.

Buyers aiming for

passive income streams

You’re looking for structured rental flows — from managed apartments, apart-hotels, or branded residences — where the operator handles occupancy and revenue.

Co-investors entering

early-stage deals

You’re open to joining a development before completion — to benefit from capital appreciation and higher returns when the project matures or sells out.

HNWI building long-term

real estate value

You’re assembling a serious property portfolio and want professional-grade offers — with legal transparency, due diligence, and strategic exit options.

Methods of purchase

real estate in 2025–2026

We offer flexible

and modern conditions for purchasing real estate. Choose a convenient method, and our specialists

will take care of everything

Cash

Ideal for those who want a quick deal without debt obligations and the risk of currency fluctuations. Our specialists will ensure minimal formalities and safe registration to avoid hidden commissions and taxes.

Mortgage

An excellent option for maintaining liquidity. We will select the optimal mortgage program in the country of purchase and take care of the legal purity of the transaction. You can be sure of the absence of hidden conditions and an honest assessment of the interest rate and payment schedule.

Installment

Provides the opportunity to split payments into several stages. A completely safe process with flexible payment terms and access to the property immediately after the transaction is completed. You will receive a full understanding of the terms to avoid surprises in the payment schedule.

Cryptocurrency

A modern way of buying, providing flexibility and security. Suitable for those who prefer anonymity and speed of transactions without reference to exchange rates. We will provide full legal control and protection so that the transaction is as reliable as possible.

Investing in real estate

is more than just buying square meters.

It’s choosing the future

Investing in real estate

is more than just buying

square meters.

It’s choosing the future

Investing

in real estate

is more than just buying

square meters.

It’s choosing the future

What to pay attention to

Projected increase in the value of the object

Legal purity of the transaction

The presence of additional expenses

Get relevant investment tips and offers straight to your email

What to pay attention to

Projected increase in the value of the object

Legal purity of the transaction

The presence of additional expenses

Get relevant investment tips and offers straight to your email

What to pay attention to

Projected increase in the value of the object

Legal purity of the transaction

The presence of additional expenses

Get relevant investment tips and offers straight to your email

We create a comfortable path to your ideal

real estate,

uniting all stages of the transaction

into a single ecosystem

We are here to answer all your questions. Get professional recommendations and solutions from our specialists.

Expert support

Each stage of the transaction is supervised by professionals with many years of experience

Turnkey

We take on all tasks: from selecting properties to legal registration and insurance, saving your time and effort.

Individual solutions

We select a strategy for your goals: from personal residence to high-yield investments.

What taxes need to be paid when buying real estate?

The amount of taxes depends on the country and the type of real estate. Typically, this is a purchase tax (2-10% of the value of the property), an annual ownership tax, and, in some cases, a profit tax on the sale. Fees for registering the transaction may also be charged.

For more details, see the article "Topic of the article". Click on the link to go

If you have not found the answer

to your question, our AI assistant is ready to help you!

Write your question in any language and get a detailed answer within a couple of minutes

If you have not found the answer

to your question, our AI assistant is ready to help you!

Write your question in any language and get a detailed answer within a couple of minutes

VelesClub Int. team here to answer

all your questions

We offer flexible and modern conditions for buying real estate for investment. Choose a convenient method, and our specialists will take care of everything.

If you have not found the answer

to your question, our AI assistant is ready to help you!

Write your question in any language and get a detailed answer within a couple of minutes

Leave request,

and VelesClub Int. experts will contact you to

Every expert of

VelesClub Int. —

is your friend

For developers, owners, brokers and agents

We help to sell your property profitably, using a comprehensive approach and professional marketing

Full transaction support:

from documentation preparation to the final stageEvaluation and promotion of the property based on market analytics

Attracting the target audience through proven channels

International Real Estate Investment Opportunities

Welcome to VelesClub Int., your trusted partner in unlocking a world of international real estate investment opportunities. Whether you’re a seasoned investor or just starting your journey, our comprehensive services help you navigate the global property market with ease and confidence. In this guide, we’ll explore how international real estate investments can diversify your portfolio and deliver long-term returns.

1. Introduction to Global Property Investments

Unlocking Global Property Investments for Savvy Investors

In today’s interconnected world, investing in real estate across borders has become more accessible than ever. International real estate investments not only offer the promise of high returns but also provide a robust strategy to diversify your investment portfolio. With properties available in emerging real estate markets worldwide, savvy investors are discovering new opportunities to secure wealth and stability.

What Are International Real Estate Investments?

International real estate investments refer to the process of purchasing property—be it residential homes, villas, or complete complexes—in countries outside your native market. These investments often include “investment property for sale” listings and “global property investments” that cater to a diverse clientele. By venturing into markets with varied economic climates, investors can leverage regional growth, reduce risk, and benefit from fluctuating property cycles.

Imagine exploring “investment real estate listings” that feature modern apartments in vibrant urban centers or exclusive homes in tranquil coastal communities. This variety opens up an array of opportunities, from buying a chic apartment in a bustling metropolis to securing a vacation home that doubles as a rental asset.

Trends and Market Insights

Recent industry trends show a significant surge in cross-border investments, driven by favorable economic policies, rising incomes, and innovative property development techniques. For instance, global property investments have seen an upward trend as investors look for “new build investment properties” that offer modern amenities and sustainable features.

Studies indicate that many regions are experiencing double-digit growth in property values, especially in areas where “international property market trends” favor modern development and quality construction. This dynamic environment presents lucrative opportunities, particularly in markets that emphasize quality, innovation, and strategic location.

The Benefits of a Diversified Investment Portfolio

One of the primary advantages of investing internationally is the ability to diversify your real estate portfolio. A diversified portfolio can help mitigate risks associated with local economic downturns or market volatility. By investing in properties across various countries, you can spread your exposure and enhance your chances of securing high ROI real estate developments.

At VelesClub Int., we understand that every investor’s needs are unique. Our full spectrum of services goes beyond simply finding the right property. We assist you with negotiations, legal due diligence, and even offer guidance on obtaining residency or citizenship in your target country. This comprehensive approach ensures that your investment decisions are well-informed and tailored to your personal financial goals.

2. Exploring New Residential Developments for Sale

Discover New Residential Developments for Sale Worldwide

Modern real estate investments are transforming the way investors view property ownership. Across 50 countries, developers are launching innovative residential projects that blend luxury with practicality. These “new residential developments for sale” represent the future of international property investments, offering state-of-the-art facilities, energy-efficient designs, and smart home technologies.

Modern Real Estate Investments: The Future of Global Properties

In today’s fast-paced market, modern real estate investments are all about integrating cutting-edge technology with contemporary design. Developers are increasingly focused on creating spaces that cater to modern lifestyles while delivering a high return on investment. Whether you’re eyeing upscale condominiums in metropolitan areas or spacious suburban homes, the new generation of properties is built to impress.

Investors looking for “modern property development investments” are finding that these new builds not only offer stylish living environments but also come with long-term benefits such as lower maintenance costs, energy savings, and enhanced security features. With an emphasis on innovation and quality, these projects often outperform traditional properties in terms of market appeal and profitability.

Quality, Location, and Innovation in New Builds

When evaluating new build investment properties, three key factors come into play: quality, location, and innovation. Quality construction ensures that your property remains a sound investment over time, while a strategic location can boost rental yields and future resale values. Moreover, innovative design elements—such as smart home systems and sustainable building practices—add a modern twist that attracts global buyers.

Imagine a residential complex where every detail is thoughtfully designed to maximize comfort and efficiency. These properties often serve as ideal “investment property catalogs” for international buyers seeking premium residential developments that align with contemporary tastes and lifestyle demands.

High ROI Real Estate Developments

At VelesClub Int., our success stories are abundant and a testament to the dynamic potential of international property investments. We have assisted numerous investors in achieving exceptional returns through carefully selected investments in both under construction homes and luxury villas. These success narratives—ranging from significant capital appreciation to steady rental incomes—demonstrate the effectiveness of our modern real estate strategies and our commitment to helping clients build robust, diversified portfolios.

If you’re interested in exploring these success stories in more detail, we invite you to connect with one of our dedicated managers. They are eager to share specific examples and insights into how our comprehensive services have translated into high ROI for investors across the globe. Simply reach out to our team, and we’ll be happy to provide you with exclusive access to our portfolio of success cases, so you can see first-hand the benefits of partnering with VelesClub Int.

Investors worldwide are embracing the idea that a well-chosen property in an emerging market can not only secure their financial future but also serve as a gateway to global investment opportunities. These success narratives reinforce the value of partnering with a reliable operator like VelesClub Int., which provides expert advice throughout every step of your investment journey.

3. A Comprehensive Guide to Buying Investment Property Abroad

Buy Investment Property Abroad: A Comprehensive Guide

Stepping into the realm of international real estate might seem daunting at first. However, with the right guidance and support, buying investment property abroad can be a seamless process. In this section, we outline essential steps and considerations to help you make informed decisions when exploring global property investments.

Navigating Global Real Estate Markets

The world of international property investments is vast and varied. From bustling cities with thriving economies to serene locales that offer a peaceful retreat, each market comes with its unique advantages. Understanding “global real estate listings” and current market trends is crucial to identifying areas with potential for growth.

It’s important to research regional economic indicators, local property laws, and future development plans. By staying informed about “international property market trends” and emerging real estate opportunities, you can pinpoint the most promising markets for your next investment.

Legal Considerations and Financing Your Investment

Investing in property abroad requires careful attention to legal and financial details. Each country has its own set of regulations governing real estate transactions, and understanding these is essential to ensure a smooth investment process. Whether you’re considering “investment property for sale” in a developed market or exploring off-plan opportunities in emerging regions, legal due diligence cannot be overlooked.

Financing international investments can also present unique challenges. Many investors benefit from tailored financing solutions that accommodate cross-border transactions. At VelesClub Int., our experienced team can help you navigate these complexities, ensuring that you secure the best possible financing terms while mitigating potential risks.

Expert Tips and Strategies for Cross-Border Transactions

Successful cross-border transactions often require a blend of local market knowledge and international expertise. Here are a few friendly tips to keep in mind:

• Do Your Homework: Before committing to any purchase, research the local market conditions, legal requirements, and cultural nuances.

• Seek Professional Guidance: Partner with experts who understand the intricacies of international real estate. Our comprehensive services include everything from property selection to legal assistance and even residency support.

• Plan for the Long Term: International investments are best viewed as a long-term strategy. Focus on properties that offer sustained value and the potential for future growth.

By following these strategies, you can confidently enter the realm of international investments and build a resilient, diversified portfolio that stands the test of time.

Invest in Under Construction Homes and Luxury Villas for High ROI

In the dynamic world of international property investments, timing is everything. Whether you’re considering Under Construction Homes for Sale or aiming for the luxury segment with Luxury Villas for Investment, early entry and strategic planning can lead to impressive returns. At VelesClub Int., our friendly experts are here to guide you every step of the way, ensuring you make informed decisions that align with your financial goals.

Under Construction Homes for Sale: Unlocking Early Investment Benefits

Investing in properties under construction offers you the unique advantage of entering the market at an early stage. By securing an investment property for sale during the development phase, you often benefit from competitive pricing before market appreciation kicks in. This early-bird advantage not only paves the way for capital gains but also opens the door to customization options tailored to your preferences. With the increasing global demand for new build investment properties, early investments in under construction homes can serve as a smart move for building a diverse portfolio.

For many international investors, these opportunities represent a dynamic entry point into emerging markets. The flexibility in financing and planning, combined with the potential for significant value growth, makes under construction properties an attractive segment of global real estate investments.

Luxury Villas for Investment: Exclusivity and Superior Returns

For investors seeking a high-end asset, luxury villas offer a compelling mix of exclusivity and high potential returns. These properties are crafted with meticulous attention to detail, combining elegant design with modern amenities. Luxury Villas for Investment not only symbolize prestige but also provide robust opportunities for rental income and long-term capital appreciation.

Owning a luxury villa means tapping into a market where quality, strategic location, and superior craftsmanship are paramount. The demand for exclusive, high-quality residential properties continues to grow, making these investments a cornerstone for those aiming to diversify with premium assets. Moreover, the stability often associated with luxury properties can offer a counterbalance to more volatile market segments, providing an added layer of security to your overall portfolio.

Evaluating Off-Plan Property Investments

Off-plan property investments involve purchasing a property before its construction is completed. This strategy can be especially attractive due to the favorable pricing and modern design tailored to current market trends. However, like all investments, off-plan projects require careful evaluation. Key factors to consider include:

• The developer’s reputation and track record.

• Project timelines and the quality of planned construction.

• Market trends and future growth potential in the region.

At VelesClub Int., we help you weigh these factors with detailed market analysis and expert insights, ensuring that your investment decision is both informed and aligned with your long-term goals.

Comparative Analysis: Under Construction vs. Completed Projects

Deciding between under construction properties and completed projects involves weighing several critical factors:

• Pricing: Properties under construction typically offer lower entry prices compared to their completed counterparts, which can result in substantial appreciation over time.

• Customization: Investing early in a project may provide opportunities for customization that are unavailable once a property is finished.

• Risk and Return: While off-plan investments carry a degree of risk—mainly related to construction delays or market fluctuations—they also offer the potential for significant returns. In contrast, completed properties may deliver more predictable income streams, though sometimes at a premium price.

Understanding these nuances helps you tailor your investment strategy to your risk tolerance and financial ambitions. With the full spectrum of services provided by VelesClub Int., you can confidently choose the option that best fits your investment profile.

Modern Real Estate Investments: Off-Plan and Turnkey Solutions

In an era where efficiency and convenience drive decision-making, modern real estate investments have evolved to offer more streamlined approaches. Off-plan and turnkey solutions are at the forefront, catering to investors who seek hassle-free transactions with high potential returns.

Off-Plan Property Investments Explained

Off-plan investments allow you to purchase a property before its construction is completed, often at a favorable price point. This approach not only gives you a head start in the market but also aligns with the growing trend of modern real estate investments that emphasize sustainability and innovation. When investing off-plan, you are essentially betting on the future success of a project—an opportunity that can yield high returns if the development meets or exceeds expectations.

At VelesClub Int., we understand the intricacies of off-plan investments. Our team provides detailed market insights and risk assessments, ensuring that you have all the information needed to make a confident decision. With a careful review of developer credentials and projected market trends, off-plan investments can become a cornerstone of your international property portfolio.

Turnkey Investment Solutions for Global Buyers

For investors who prefer a ready-to-go solution, turnkey properties offer an all-inclusive package where the property is delivered fully operational. Turnkey investments eliminate the complexities associated with construction or renovation, allowing you to start generating returns from day one. These solutions are particularly popular among those seeking immediate income or a seamless transition into property management.

At VelesClub Int., our turnkey investment solutions are designed to simplify your buying process. We manage everything from property selection to legal documentation, ensuring that your investment journey is smooth and stress-free. This comprehensive approach not only saves you time but also provides peace of mind, knowing that every detail is handled by seasoned professionals.

Success Stories: High ROI Real Estate Developments

While specific case studies are not on hand, the overarching trend in international real estate underscores the success of modern investment strategies. Many investors have reported significant returns by embracing off-plan and turnkey solutions—evidence of the robust potential in today’s property market. These success stories are a testament to the benefits of aligning with experienced professionals who can navigate market complexities and identify high ROI real estate developments.

Investors worldwide are increasingly turning to these modern solutions, which combine innovation with proven strategies to yield strong financial returns. Whether you are new to international investments or an experienced buyer, these approaches offer exciting opportunities to enhance your portfolio.

Diversify Your Portfolio with Global Real Estate Listings

As you explore the vast opportunities available in international property markets, remember that diversification is key to long-term investment success. The spectrum of options—from under construction homes to luxury villas and turnkey properties—allows you to build a resilient and profitable portfolio tailored to your unique financial goals.

Recap of Key Investment Opportunities

In this guide, we’ve explored:

• The benefits of diversifying your portfolio with international real estate investments.

• The promising prospects of new residential developments for sale, emphasizing modern design, quality construction, and strategic locations.

• A comprehensive walkthrough on buying investment property abroad, covering market navigation, legal considerations, and financing strategies.

• The distinct advantages of investing in both under construction homes for sale and luxury villas for investment, each offering unique value propositions.

• Modern investment strategies, including off-plan property investments and turnkey solutions, that simplify the process and maximize returns.

These insights serve as a robust foundation for developing a well-rounded investment strategy that leverages the strengths of various property types and market trends.

Next Steps: How to Secure Your Investment Property

Taking the leap into international real estate investment starts with a clear understanding of your goals and a commitment to thorough research. Here are some actionable steps to guide you:

• Research Extensively: Familiarize yourself with market trends, economic indicators, and property listings across your regions of interest.

• Consult Experts: Leverage the comprehensive services of VelesClub Int. for personalized guidance—from property selection to legal and financial support.

• Evaluate Opportunities: Consider the pros and cons of different property types, such as off-plan versus completed projects, to align with your investment strategy.

• Plan Your Finances: Assess various financing options to secure the best terms for your investment, ensuring a smooth transaction process.

Connect with VelesClub Int. for Exclusive Investment Opportunities

At VelesClub Int., our commitment goes beyond merely finding you the perfect property. We offer a full spectrum of services designed specifically for international real estate investors. Our expertise spans:

• Property selection and negotiation to secure the most competitive prices.

• Comprehensive legal support to ensure a secure and transparent transaction.

• Assistance with residency, citizenship, and other related services, making your global investment journey as seamless as possible.

If you’re ready to explore our exclusive catalog of investment properties—featuring detailed listings by country with prices, descriptions, and photos—or simply want to speak with one of our friendly experts, we invite you to take the next step. Visit our Contacts page or browse through our investment property catalog to discover unparalleled opportunities in global real estate.

By partnering with VelesClub Int., you’re not just investing in property—you’re investing in a trusted network of professionals dedicated to your success. Embrace the future of international real estate investments with confidence, and let us help you build a diverse, high-performing portfolio today.