Secondary real estate in Saint MartinIsland life between Caribbeanrhythm and coastal calm

Popular

cities and regions in Saint Martin (French)

Best offers

in Saint Martin (French)

Benefits of investment in

Saint Martin real estate

Dual-culture Caribbean destination

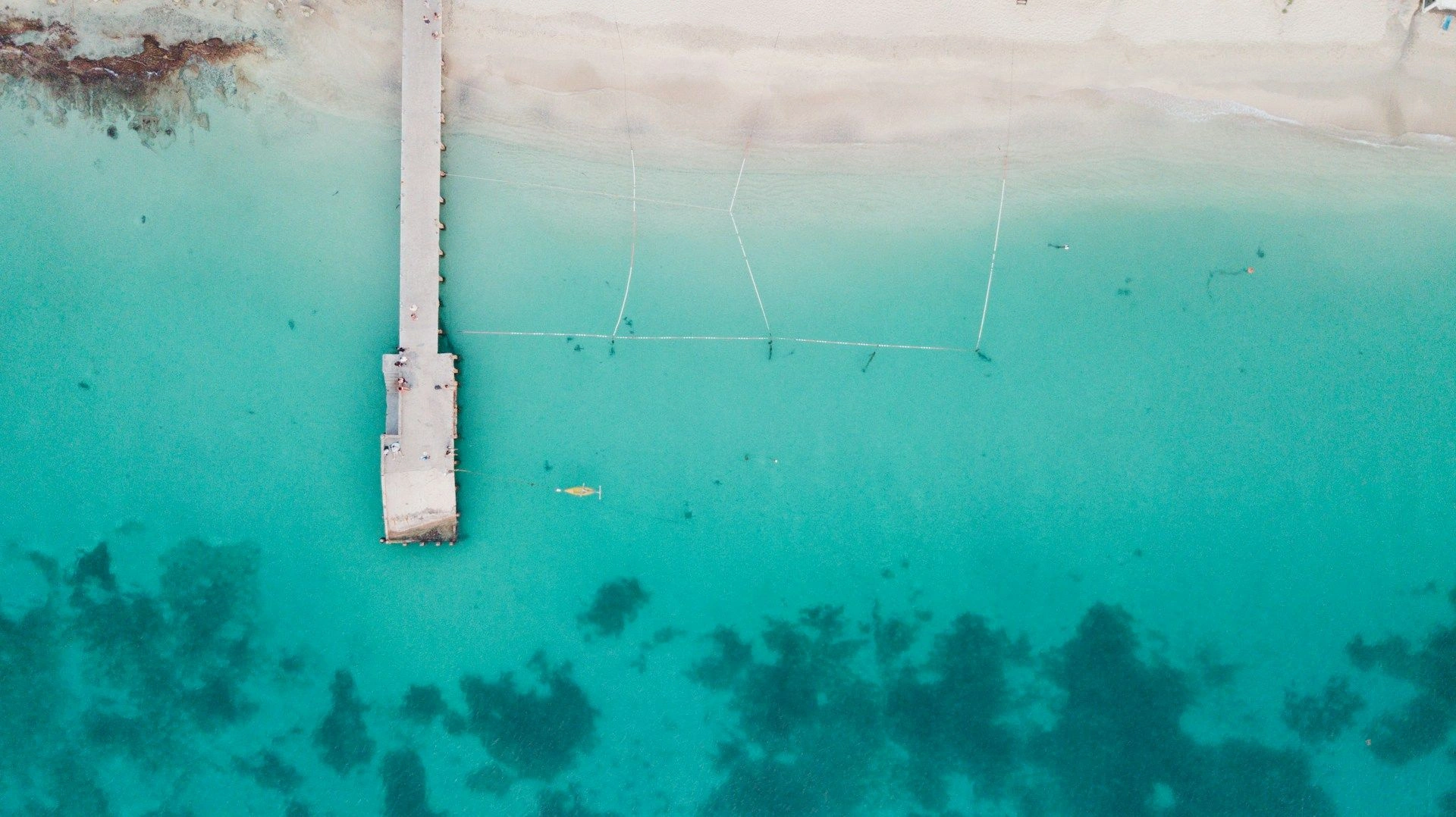

Saint Martin blends French and Dutch influence — attracting lifestyle investors, yacht travelers, and hospitality projects.

Oceanview properties with short-term rental appeal

Seaside homes and resort condos perform well during the tourist season and benefit from European-standard amenities.

Investment formats in a tourism-driven market

Buyers can enter via residential or mixed-use properties, often under hotel-style management.

Dual-culture Caribbean destination

Saint Martin blends French and Dutch influence — attracting lifestyle investors, yacht travelers, and hospitality projects.

Oceanview properties with short-term rental appeal

Seaside homes and resort condos perform well during the tourist season and benefit from European-standard amenities.

Investment formats in a tourism-driven market

Buyers can enter via residential or mixed-use properties, often under hotel-style management.

Useful articles

and recommendations from experts

Main title about secondary real estate in Saint Martin

Why secondary properties attract buyers

Secondary real estate in Saint Martin grants investors and homebuyers immediate access to fully operational Caribbean homes—bypassing the permitting delays, material shortages and finish-quality variances of new builds. Pre-owned villas, townhouses and condominiums across Orient Bay, Grand Case, Marigot and Simpson Bay are turnkey ready: connected to potable water from SEMSAMAR, uninterrupted electricity via Électricité de Saint-Martin with automatic generator backups, modern sewer and storm-water drainage maintained by Collectivité de Saint-Martin, and well-paved asphalt roads. High-speed fiber-to-the-premise broadband from SFR Caraïbe, Digicel and Orange, alongside comprehensive 4G/5G coverage, ensures reliable connectivity for remote work, streaming and smart-home integration. Interiors often blend authentic Caribbean flair—exposed timber beams, coral-stone accents and louvered shutters—with contemporary upgrades: energy-efficient glazing rated for tropical storms, bespoke open-plan kitchens fitted with European appliances, reinforced concrete footings engineered for coral-reef substrates, integrated solar-thermal water heating, ductless split-system climate control, LED lighting and pre-wired smart-home controls. This genuine move-in readiness slashes post-purchase capex, accelerates rental cash flows and empowers buyers—from holiday-let entrepreneurs and corporate transferees to digital nomads and yield-focused investors—to begin generating returns or enjoying premium island living from day one. VelesClub Int.’s off-market sourcing, transparent valuation benchmarks and full-service advisory ensure a seamless acquisition journey.

Established neighbourhoods

Saint Martin’s resale market is anchored by several mature micro-regions with distinct appeal. Orient Bay, the “Saint-Tropez of the Caribbean,” features low-rise condo towers, beachfront villas and upscale restaurants—ideal for vacation-rental performance and expatriate stayovers. Grand Case, the island’s culinary capital, hosts renovated guesthouses and hillside estates overlooking the lagoon—prized for gastronomic-tour yields. Marigot, the French-side capital, combines historic colonial townhouses and modern flats along the marina—favored by diplomatic and corporate tenants. Simpson Bay, adjacent to Princess Juliana Airport, offers canal-front villas, yacht-berths and mixed-use complexes—optimal for maritime professionals and holiday hosts. Emerging belts near the Loterie Farm nature reserve and the Colombier ridge present value-add prospects in subdivided eco-lodges and mixed-use conversions, buoyed by ongoing infrastructure upgrades and eco-tourism growth. Across all precincts, municipal services—scheduled waste removal, reliable utility mains, fiber-optic nodes and integrated bus and ferry links—operate without interruption, ensuring minimal maintenance and effortless community integration.

Who buys secondary real estate

The buyer profile in Saint Martin’s secondary segment reflects the island’s cosmopolitan mix. Holiday-let operators and boutique hotel investors acquire turnkey villas and condos in Orient Bay and Grand Case, leveraging VelesClub Int.’s property-management and dynamic revenue strategies to maximize seasonal yields. Corporate transferees and NGO staff secure fully furnished apartments in Marigot and Simpson Bay for medium-term postings—valuing inclusive lease packages, compound security and proximity to transport hubs. Diaspora families from Europe and North America invest in villa estates on the Colombier hillside and eco-lodges near Loterie Farm for long-stay residency and capital preservation. Digital nomads and remote-working professionals rent beachfront suites and canal-front apartments for seamless connectivity and lifestyle convenience. Across all segments, shared drivers include true turnkey readiness, preserved architectural character, transparent title histories and integration into robust infrastructure networks that underpin reliable returns and lifestyle quality.

Market types and price ranges

Saint Martin’s secondary-real estate offering spans a broad continuum of property types and price tiers. Entry-level studio apartments and one-bedroom flats in low-density sectors start from approximately USD 150 000 to USD 300 000—featuring turnkey finishes, communal amenities and proximity to bus or ferry stops. Mid-range two- to three-bedroom townhouses, duplex villas and garden-level condos in Orient Bay, Grand Case and Marigot trade between USD 350 000 and USD 800 000, offering granite countertops, modern baths, private verandahs, secure parking and shared pools. Premium detached beachfront estates, restored colonial manors and luxury hillside villas command USD 900 000 to over USD 3 000 000—driven by sea frontage, bespoke interior fit-outs, landscaped grounds and branded concierge services. For institutional and portfolio investors, small condominium clusters (4–8 units) in emerging belts list between USD 500 000 and USD 1 200 000, delivering diversified rental streams and scale-efficiency yields. Financing through regional and offshore banks—Eastern Caribbean Central Bank corridors and French banking partners—offers competitive mortgage schemes at 4%–6% per annum with typical down payments of 20%–30%. Documented net rental yields average 6%–8% per annum across core corridors—benchmarks integrated by VelesClub Int. into proprietary yield-modelling and strategic acquisition-planning tools.

Legal process and protections

Purchasing secondary real estate in Saint Martin follows French Overseas Collectivity conveyancing under the Civil Code and Arrêté préfectoral regulations. Transactions begin with a signed Promesse de Vente and deposit (5%–10%) held in escrow by a notary. Buyers conduct due diligence: obtaining a Certificat d’Urbanisme and land-use zoning confirmation, commissioning boundary and structural surveys, verifying heritage listings and easements, and auditing utility-connection statuses with SEMSAMAR and Électricité de Saint-Martin. Upon clearance, parties execute the Acte Authentique; stamp duty (5.81% including registration fees), notarial fees and publication charges are paid. The deed is registered in Service de la Publicité Foncière, granting formal title and public notice. EU/EEA citizens enjoy full acquisition rights; non-EU nationals submit a déclaration d’investissement and comply with density regulations. VelesClub Int. orchestrates end-to-end legal coordination—due-diligence management, notary liaison and registry filings—to ensure compliance, risk mitigation and a seamless closing experience.

Best areas for secondary market

Certain micro-markets in Saint Martin stand out for infrastructure maturity, amenity clustering and rental performance. Orient Bay yields net returns of 7%–8% driven by underwater-sports and beach tourism. Grand Case delivers returns of 6% backed by gastro-tourism and villa rentals. Marigot’s harbourfront precinct achieves yields of 6%–7% supported by corporate and diplomatic leases. Simpson Bay sustains yields near 7% from maritime and airport-adjacent tenancy. Emerging belts around Colombier ridge and Loterie Farm present value-add prospects—yielding 8%–9% as eco-tourism and infrastructure enhancements progress. Each precinct benefits from sealed roads, reliable utility mains, fiber-optic broadband, integrated bus and ferry links, and proximity to airports, marinas, schools and healthcare—ensuring transparent pricing, consistent occupancy and strong resale liquidity. VelesClub Int.’s proprietary neighbourhood-scoring methodology and on-the-ground research guide clients to sub-markets that optimally align yield targets, capital-growth forecasts and lifestyle preferences within Saint Martin’s dynamic secondary real-estate ecosystem.

Why choose secondary over new + VelesClub Int. support

Opting for secondary real estate in Saint Martin delivers immediate possession, proven infrastructure and transparent historical performance—advantages rarely matched by speculative new-build projects facing permitting delays, supply-chain volatility and contractual risks. Buyers avoid off-plan premiums and extended delivery timelines by selecting turnkey assets with operational water, power, broadband and reinforced foundations already in place. Secondary properties often showcase irreplaceable Caribbean and Creole architectural character—colonnaded verandahs, decorative shutters and coral-stone façades—that new constructions cannot replicate, enhancing authenticity and long-term desirability. Lower entry premiums relative to green-field or off-plan schemes free up capital for interior personalization, sustainable upgrades (solar PV, rainwater harvesting) or strategic portfolio diversification across multiple micro-markets. Mature services—reliable SEMSAMAR water, uninterrupted Électricité de Saint-Martin power, sealed roads, integrated bus and ferry networks, and high-speed fiber broadband—ensure seamless move-in and minimal maintenance. VelesClub Int. enriches this acquisition journey with comprehensive end-to-end expertise: sourcing exclusive off-market listings, conducting exhaustive due diligence, negotiating optimal terms and managing all legal formalities. Our post-closing property-management solutions—tenant placement, preventive maintenance coordination and transparent performance reporting—optimize occupancy rates and preserve capital value. Through proactive portfolio monitoring, annual market reviews and strategic advisory, VelesClub Int. empowers clients to maximize Saint Martin’s secondary real estate potential with confidence, clarity and operational efficiency.